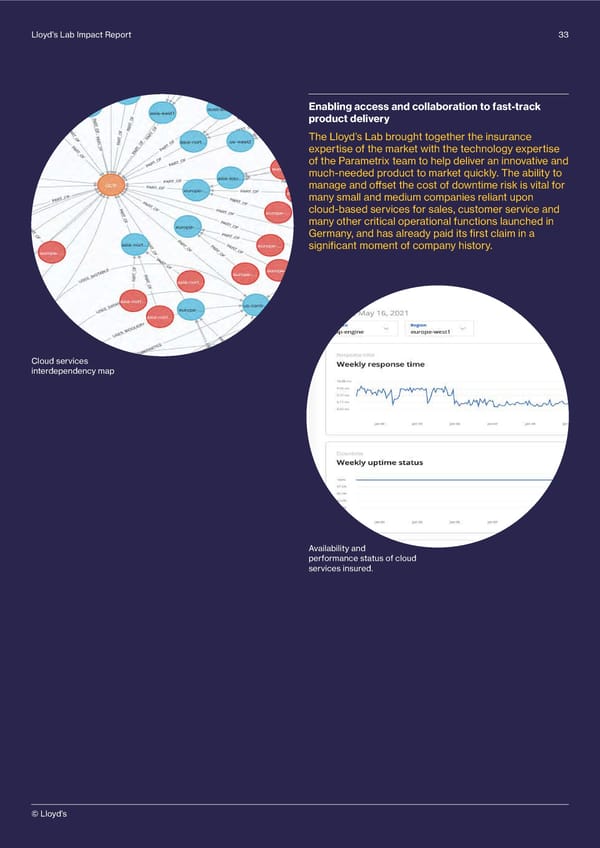

32New products/ MGA Lloyd’s Lab Impact Report 33 Parametrix cloud downtime cover: Enabling access and collaboration to fast-track closing the protection gap for clients product delivery The Lloyd’s Lab brought together the insurance Cohort 4, 2020 expertise of the market with the technology expertise of the Parametrix team to help deliver an innovative and much-needed product to market quickly. The ability to manage and o昀昀set the cost of downtime risk is vital for many small and medium companies reliant upon Parametrix has the distinction of delivering a true 昀椀rst in the Lloyd’s Lab. cloud-based services for sales, customer service and The founders, seasoned tech startup professionals, wanted to create new many other critical operational functions launched in Germany, and has already paid its 昀椀rst claim in a class of parametric insurance – downtime business interruption cover. signi昀椀cant moment of company history. Following their participation in Lloyd’s Lab cohort 4, they have now launched their product in multiple markets worldwide. Parametrix’s innovative business interruption policy covers companies when business-critical, cloud-based services go down. Such events often lead to a loss of access to third-party services such as cloud computing and cloud storage, SaaS accounting, Cloud services payment gateways, stock or client databases, or interdependency map e-commerce platforms. Parametrix monitors the availability and performance of all the major cloud data centre providers and pay out directly to the client when they detect an outage event, without the need to make a claim. The policy pays out an agreed amount once an outage has been going on for more than an hour, then adds to it in increments of 昀椀fteen minutes. The amount paid is based on the client’s own pre-agreed assessment of the amount of money lost per hour during an outage of a particular service. The Lab: new opportunities Availability and The Parametrix team had a background in tech, a history performance status of cloud of entrepreneurship, and a cloud monitoring protocol in services insured. place. They had already begun the process of speaking to reinsurers but for them, time to market was a critical factor. The Lloyd’s Lab accelerated the process from Downtime detection by Parametrix Monitoring modelling and actuarial analysis through to launch, while System, Japan 2019 helping them to understand the Lloyd’s market and connecting them with potential capacity providers. More than a dozen insurers and reinsurers signed up By the end of the Lab programme, Parametrix had to work with Parametrix during the Lloyd’s Lab 昀椀nalised the actuarial analysis to create a viable SME programme, and it wasn’t just Parametrix that gained business interruption product and had secured the insight. Learning sessions organised through the Lloyd’s capacity to back it. Lab helped mentors understand policy options to cover business interruption risk due to downtime. Insurers and reinsurers were also able to provide input on how to turn Parametrix’s tool into a viable insurance product. © Lloyd’s

Lloyds Lab Impact Report Page 32 Page 34

Lloyds Lab Impact Report Page 32 Page 34